PRESCRIPTION DRUG PLAN

Things You Should Know

So, what exactly is a Prescription Drug Plan?

A prescription drug plan (PDP) is a government program that helps cover the cost of medications, prescription drug plan are only offered by private insurance companies contracted with CMS. If you’re eligible for Medicare, you’re eligible for a prescription drug plan. Original Medicare (Part A and B) doesn’t include drug coverage.

WHEN TO ENROLL in a Prescription Drug Plan

You can only switch plans or start during certain times of the year. When you are turning 65 the 1st and last day, three months before and after your birth month or become eligible for Medicare. A seven-month period, i.e. someone born in June could enroll March 1st through September 30th. Coverage will start no sooner than 1st day of your birth month if done before hand, or no later than the 1st of the following month.

If you have prescription drug coverage through your employer or VA, you don’t need to enroll unless you lose that coverage. Also for now October 15th through December 7th is called the annual Open Enrollment Period, you can also enroll in a prescription drug plan or switch plans. If you enroll during this time, coverage will begin January 1st, but annually formulary, pharmacy network, premium and or co-payments and co-insurance may change so keep up to date.

If a life change causes you to lose your prescription drug coverage, you may be eligible for a Special Election Period (SEP) If you miss these enrollment periods, you may have to wait until the following year to enroll. You may also have to pay the Medicare late-enrollment penalty (LEP) this is based on how many month you did not have coverage.

*Much of this section doesn’t apply to individuals that get help from government agencies for prescription medication i.e. LIS, QMBs, Medicaid.

WHY

Choose a Medicare Prescription Drug Plan?

Well first, let's talk about the pocket book. Some people have taken good care of themselves, only taking over the counter or generic medications and I applaud you.

Most know well the cost and without a plan you will pay full price and all the cost of your prescription. So this is for the healthy now individuals count your saving well if you choose not to select a plan, the cost of medications is not the end of it. If you do not have valid, provable coverage the Medicare late-enrollment penalty (LEP) could hurt you for the rest of your life! This year (2014) the average prescription drug plan (PDP) is set at $32.42. Each month you don’t have coverage 1% of the year set average is added to you future premium. Example you select a plan with a $19.30 monthly premium (payment) and you are 12 months past your eligible start date, 12% ($3.89) will be added for $23.19, and if you are 10 years 120% ($38.88) is added to your premium for $58.18. Even if the company you sign up with don’t notice, Medicare will and force collection by the company or cancel the plan for nonpayment.

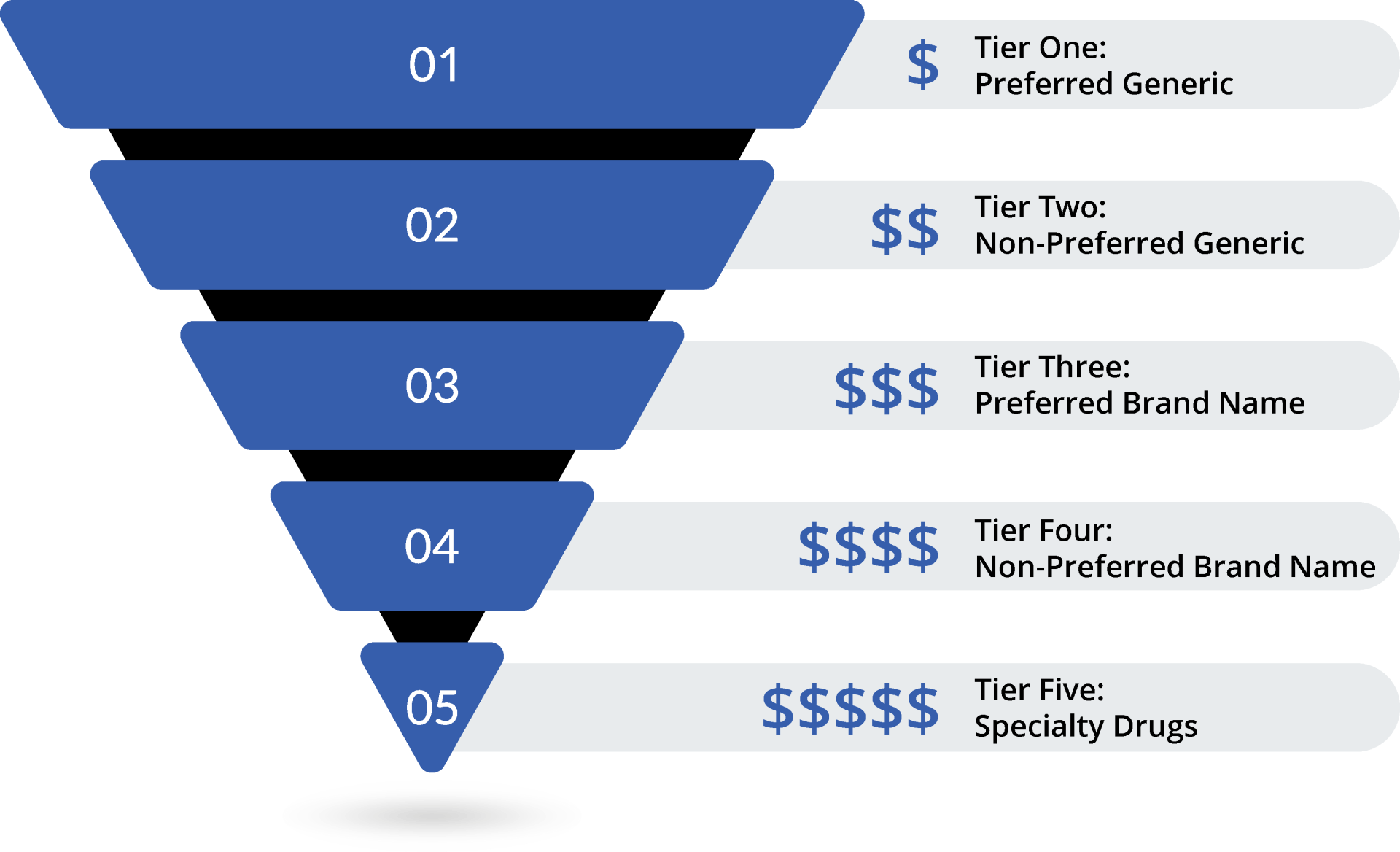

Tiers and Formulary

*Tier is no more than grouping of medications together by cost.

Each prescription drug plan has its own tier system; medications could be a tier 4 on one plan but 3 on another.

Formulary is a fancy word for drug list. Typically the less you pay for a prescription drug plan the shorter the list and or higher the deductible. Be sure to check the medications you are taking now against this list or it could lead to problems down the road. If later you need a drug that is not covered by the formulary, your doctor would need to contact the PDP Company for pre-approval.

Deductibles, Coverage Gap and Catastrophic

Deductibles work the same with prescription drug plans as they do with healthcare plans. You pay the cost of medications at a discounted rate until the deductible is met. After you just continue paying your premium and what ever copay for that tier medication.

The coverage gap is also known as the donut hole. This year (2014) limit is when you and the plan spend $2,850 on prescription medication. This is why it’s important to keep up with what is being charged to your account even if the copay for the medication is $0. After this point your cost for prescription will increase, up to 72% of the total cost for generic drugs or 47.5% of the total cost for brand name drugs. Your cost will remain at this level until you have paid $4,550 out-of-pocket.

Catastrophic coverage starts after the $4,550. At this point you pay the greater of $2.55 copay for generics and $6.35 copay for brand name medication, or 5% coinsurance for specialty medication.